Loans For The Delivery Of Precious Stones After Auction

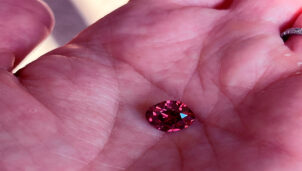

Winning a rare diamond, sapphire, or emerald at an auction is only the beginning of ownership. Once the gavel falls, the challenge becomes moving that stone safely to its final destination. Unlike everyday purchases, precious stones demand secure, insured, and highly specialized logistics. These processes are expensive, sometimes costing as much as smaller lots themselves. To cover these costs, many buyers turn to banks for short-term financing. Loans for delivery services may not be as glamorous as bidding on a rare gem, but they are essential for ensuring that valuable assets arrive intact and protected. Banks and financial institutions have developed tailored products to meet this very need.

Why Delivery Financing Exists

Transporting precious stones is not a simple courier job. It requires armored vehicles, trusted handlers, international permits, and comprehensive insurance. Auction houses often provide temporary custody, but buyers must arrange final delivery. Costs escalate when the lot crosses borders or requires multiple stages of security checks. Even wealthy collectors or dealers may prefer financing these logistics instead of tying up liquid capital. Loans bridge the gap, allowing buyers to secure transport immediately while spreading costs over time. Delivery financing ensures the stone moves safely without disrupting broader investment strategies. In this sense, the financial system supports not only trade but also the physical safety of assets.

The Cost Drivers Behind Secure Transport

Fees for armored logistics firms, specialized insurance policies, customs clearance, and certified couriers all add up. The larger the distance and the rarer the gem, the higher the bill. This is why banks step in with targeted loan products, keeping deals efficient and secure.

How Banks Structure Delivery Loans

Banks treat delivery loans as short-term credit, often secured by the value of the gem itself. Repayment periods are usually brief—weeks or months—since the borrower expects quick turnover after resale or settlement. Interest rates are lower than unsecured loans because collateral is strong and the asset has clear market value. The process is streamlined: once a buyer wins a lot, the auction house or logistics firm coordinates with the financing bank to release funds for transport. The bank essentially underwrites security, ensuring that logistics firms get paid on time while buyers manage liquidity with less strain.

Key Features Of Delivery Financing

Short terms, asset-backed security, and tight coordination between banks, auction houses, and couriers distinguish these loans. They are less about speculation and more about bridging operational needs in a high-value market.

| Feature | Why It Matters | Typical Practice |

|---|---|---|

| Collateral | Ensures low risk for lenders | Stone itself used as security |

| Repayment Term | Matches logistics timeframe | 2 weeks to 6 months |

| Interest Rates | Lower than unsecured loans | Competitive, often single digits |

| Coordination | Reduces delays and risk | Banks liaise with logistics firms |

The Role Of Specialized Logistics Firms

Even with financing secured, logistics remain complex. Banks often work with trusted partners—global firms specializing in transporting jewels, artworks, and luxury goods. These companies maintain high-security vaults, armed couriers, and insurance partnerships. Buyers benefit because the financing package often includes bundled services: loan, transport, and coverage combined. Without these arrangements, buyers would have to negotiate each element separately, increasing the chance of errors. In high-value markets, coordination is everything. A misstep in transport can cost millions, so banks prefer to handle financing through established networks rather than leaving clients to improvise.

Insurance Integration

One of the most important components is insurance. Without it, even the most secure transport leaves exposure to theft, damage, or loss. Delivery loans frequently cover the cost of premium insurance policies, ensuring full protection throughout the journey.

Why Collectors And Dealers Use Loans Instead Of Cash

At first glance, it may seem unusual that wealthy collectors or large dealers would need delivery loans. Yet even well-funded buyers prefer not to tie up liquid capital in logistics. For dealers, cash flow is better reserved for the next purchase or inventory management. For collectors, loans provide flexibility while keeping other investments untouched. Financing delivery spreads the cost without delaying the secure transfer of assets. In competitive markets, this speed matters. Loans also create clear paper trails, reassuring auction houses and regulators about compliance in high-value transfers.

Liquidity Management

Borrowers see loans as a way to manage liquidity smartly. By outsourcing delivery costs to short-term credit, they preserve their resources for core activities—buying, selling, or investing in other assets.

Cross-Border Complexities

When stones travel across borders, the complexity of logistics multiplies. Customs clearance, legal certifications, and tax considerations all come into play. Banks with global networks help streamline this process by financing not only transport but also ancillary costs. Delivery loans may include allowances for duties, permits, or bonded storage until final clearance. Without financing, delays can trap stones in transit, exposing buyers to risk and potential loss. In high-stakes markets, smooth cross-border movement is critical. Loans provide the financial lubricant that keeps deals moving across jurisdictions without unnecessary stalls.

Coordination With Regulators

Reputable banks also coordinate with customs officials and regulators to ensure compliance. This adds another layer of security, preventing seizures or disputes during transfer. For borrowers, financing through banks simplifies the bureaucratic maze of cross-border delivery.

The Risks If Delivery Isn’t Properly Financed

Skipping proper financing can lead to shortcuts. Some buyers may attempt to self-manage logistics, cutting costs on insurance or using unreliable carriers. This increases exposure to theft, fraud, or damage. Others may delay delivery due to cash constraints, leaving stones stored temporarily in less secure facilities. Both approaches create unnecessary risks in an already sensitive trade. Banks prefer to prevent these outcomes by offering structured delivery loans, ensuring stones move safely and promptly. Proper financing is not only about convenience—it reduces systemic risk for everyone involved in the transaction.

Theft And Fraud Risks

History shows that unprotected shipments of gems are prime targets for theft. Fraudulent logistics providers also exploit buyers who try to save money. By embedding financing into secure networks, banks shield clients from these vulnerabilities.

How Delivery Loans Shape The Auction Ecosystem

Delivery loans don’t just benefit individual buyers; they reinforce the integrity of the entire auction ecosystem. When stones are consistently delivered securely and on time, market trust grows. Auction houses can reassure sellers that their lots will reach buyers safely. Buyers feel confident to bid higher, knowing that post-sale logistics won’t derail the process. Banks, in turn, strengthen relationships with both sides, expanding their role beyond pure financing into guardians of market stability. Over time, this creates a virtuous cycle: strong financing options encourage participation, which sustains vibrant auctions, which in turn fuel further financing demand.

Integration With Auction Houses

Some auction houses already partner directly with banks to offer delivery financing as part of the settlement process. This seamless integration reduces delays and removes barriers for international buyers who may face complex logistics.

The Conclusion

Delivering precious stones after auctions is one of the most delicate stages in the entire trade. Secure logistics are expensive, but skipping them is not an option. Banks step in with short-term delivery loans that cover transport, insurance, and cross-border compliance, ensuring assets move safely while buyers manage liquidity. These loans are practical tools that protect buyers, sellers, and the market itself. By financing secure delivery, banks extend their role from funding purchases to safeguarding the physical journey of assets. In the high-value world of gem auctions, financial services and logistics go hand in hand, proving that every investment is only as strong as the system that protects it on the way home.