How to Stay on Trend in the Gemstone Investment Market

The gemstone market moves fast, influenced by fashion cycles, cultural shifts, and global economics. Investors who want to profit need more than luck—they need awareness of what stones are in demand, how tastes are changing, and where opportunities are emerging. Staying on trend means tracking data, following auctions, and understanding the difference between timeless value and short-lived hype. In 2025, investors are watching sustainability, digital marketplaces, and cultural demand as key drivers. The question is: how do you spot the right moment to enter and avoid being caught when trends shift?

Understanding How Trends Form in Gemstones

Unlike commodities such as gold or oil, gemstones are not traded on centralized exchanges. Their value depends on rarity, cultural symbolism, and market momentum. A stone that is unfashionable today may surge in price tomorrow if luxury brands promote it or if a cultural moment drives interest. For example, colored diamonds once trailed white diamonds in popularity, but celebrity endorsements and marketing campaigns turned them into prestige items. Investors must track not just geology but also marketing and consumer behavior. A sudden fashion shift, a high-profile auction sale, or even a social media trend can influence demand. Recognizing these patterns before they become mainstream is what separates successful gemstone investors from those left holding stones that no longer command premium value.

Why Timing Is Critical

Buyers who spot trends early can secure stones at lower prices, while latecomers often overpay. Understanding when to act requires monitoring both consumer demand and supply control by large mining firms.

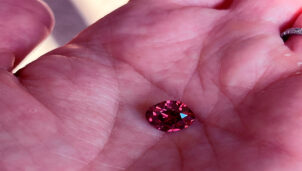

Identifying High-Demand Stones in 2025

Certain gemstones are gaining attention this year. Colored sapphires, particularly those with unique hues like teal or padparadscha, have been rising in demand due to their rarity and appeal to younger luxury buyers. Emeralds continue to hold steady as a symbol of heritage wealth, while pink and blue diamonds attract investors as long-term stores of value. Ethical sourcing is another trend: stones with verified origins and sustainable mining practices command premiums. Auction data shows a clear uptick in interest for stones tied to ethical branding. Investors who align portfolios with these trends stand to benefit both financially and reputationally, since buyers increasingly view sustainability as part of value.

Stones on the Rise in 2025

| Gemstone | Reason for Demand | Investor Outlook |

|---|---|---|

| Colored sapphires | Unique hues, millennial and Gen Z appeal | Strong short-to-medium term |

| Emeralds | Luxury heritage, strong global recognition | Stable long-term |

| Pink/blue diamonds | Rarity, auction record highs | Strong long-term hold |

| Ethically certified stones | Transparency, sustainability premium | Growing across all categories |

Using Auctions to Spot Trends Early

Auctions remain the best barometer of gemstone demand. When certain lots outperform expectations, it signals a shift in investor appetite. A surge of bids for a particular stone often triggers a wider market reaction, with prices rising in retail and private sales shortly after. Monitoring auction results is therefore critical. Investors who analyze not just final sale prices but also bidding patterns can spot emerging trends before they spread. For example, consistent interest in teal sapphires at recent auctions indicates that demand is broadening beyond traditional markets. Staying informed requires reviewing catalogs, watching live auctions, and comparing estimates with results to see which stones are outperforming predictions.

How Auction Signals Work

When demand for a gemstone spikes at auctions, it often spreads quickly to dealers and retailers. Smart investors use auction data as an early-warning system to reposition their portfolios.

The Role of Culture and Marketing in Driving Demand

Cultural narratives drive gemstone markets in ways few investors expect. A single film, celebrity endorsement, or royal wedding can shift demand overnight. For instance, sapphire engagement rings gained renewed attention after high-profile media coverage. Luxury brands also play a powerful role. When they highlight certain stones in seasonal collections, demand among consumers often spikes. For investors, this means cultural awareness is as important as geological knowledge. Staying current on fashion cycles, celebrity choices, and advertising campaigns helps anticipate which stones will rise in value. In 2025, the intersection of fashion, luxury branding, and social media continues to drive gemstone preferences globally.

Beyond Traditional Markets

Trends no longer form only in Europe or North America. Demand in Asia and the Middle East increasingly drives global prices, especially for high-end diamonds and colored stones.

Risks of Chasing Short-Term Trends

Not all gemstone trends are sustainable. Some fade quickly, leaving investors with stones that lose value. The challenge is distinguishing between a fad and a long-term shift. For instance, heavily marketed but lower-quality stones may generate hype temporarily but fail to maintain value once novelty fades. Investors who chase short-lived trends risk overpaying. It is safer to balance speculative purchases with stones that have proven long-term demand, such as diamonds, sapphires, and emeralds. Diversification remains the most practical hedge. Instead of putting capital into a single trendy stone, spreading risk across multiple categories ensures stability while still capturing upside potential from emerging markets.

How to Avoid the Trap

Review historical performance, compare auction data, and verify quality certifications before committing capital. Trends can be profitable, but they require discipline and realism.

Forward-Looking Outlook for Gemstone Investors

Looking ahead, several forces will shape gemstone markets. Blockchain verification is gaining traction, offering buyers confidence in origin and quality. Digital auction platforms are broadening access, making bidding more global and competitive. Sustainability is likely to remain a central driver, with ethically mined stones commanding premium pricing. In addition, generational demand will matter: younger buyers increasingly seek uniqueness and individuality in stones, favoring colored gems with rare tones over traditional options. For investors, this suggests a future where both long-term classics and niche stones can coexist profitably. Staying informed and flexible will be the defining trait of successful investors in the coming decade.

What to Watch in the Next Five Years

Expect ongoing growth in demand for ethically sourced stones, greater use of digital platforms for auctions, and rising importance of cultural signals in shaping global gemstone trends.

Conclusion

Staying on trend in the gemstone market requires a mix of research, cultural awareness, and financial discipline. Investors who follow auctions, monitor cultural shifts, and track sustainability initiatives can identify opportunities early and position themselves for gains. While risks exist—especially when chasing short-term hype—balanced strategies that mix timeless stones with emerging favorites create resilience. In 2025 and beyond, the gemstone market will continue to evolve, driven by global demand, generational preferences, and digital innovation. Those who adapt quickly and stay alert to signals will not just follow trends but capitalize on them.