Blockchain Loans for Gemstone Transactions

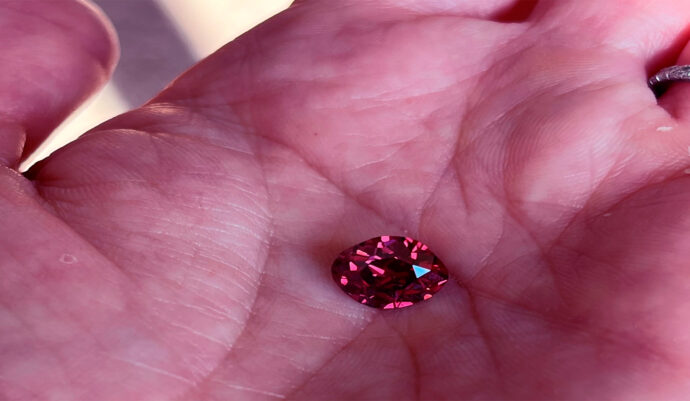

Gemstone auctions have always involved high stakes, opaque practices, and significant financial risks. Buyers rely on loans to compete for rare stones, yet traditional lending often lacks transparency. Enter blockchain. By introducing smart contracts into auction lending, blockchain technology promises greater security, automated agreements, and instant verification. For gemstone investors and lenders alike, it could transform how credit is extended, monitored, and repaid. But how does this new model actually work, and is it as revolutionary as it seems?

Why Blockchain Appeals to Gemstone Finance

Gemstone transactions are complex. Each stone is unique, valuations fluctuate, and trust is critical. In traditional lending models, loan agreements depend on manual processes, paperwork, and intermediaries. Delays and disputes are common. Blockchain changes this by providing a shared, tamper-proof ledger. Smart contracts—self-executing agreements coded into the blockchain—trigger loan disbursements, repayments, or collateral releases automatically once predefined conditions are met. This reduces reliance on third parties and eliminates ambiguity. For lenders, it means greater confidence that borrowers will follow through. For borrowers, it means faster access to credit and less bureaucratic friction. In an industry often criticized for secrecy, blockchain offers transparency where it is most needed. Yet the technology also brings new questions about adoption, compliance, and scalability.

Why Transparency Matters

Loans tied to gemstones often face disputes about collateral value or repayment. Blockchain records provide a permanent, verifiable history of terms and execution, reducing opportunities for manipulation or error.

How Smart Contracts Reshape Auction Lending

At a gemstone auction, timing is critical. Buyers need instant access to funds to secure a winning bid. With traditional banking, approvals may take days, but blockchain-enabled loans can release funds immediately once coded conditions are met. For example, a bidder could prearrange a smart contract loan that activates only if they win a lot. The moment the auction ends, funds are released, and repayment terms begin. Collateral—often another gemstone or portfolio of assets—can be locked into the contract, ensuring security for the lender. Repayments, too, are automated, reducing defaults and disputes. This automation streamlines the process, cutting costs and delays. However, while the logic is simple, the real challenge lies in coding contracts robust enough to handle the nuances of gemstone trading.

Instant Execution

Smart contracts eliminate the need for multiple approvals. When the hammer falls, the loan activates automatically, removing the risk of missing out due to delayed financing.

Advantages of Blockchain-Based Loans

The benefits extend beyond speed and transparency. Blockchain provides traceability of both the gemstone and the loan contract, which is especially valuable in an industry facing scrutiny over fraud and ethical sourcing. Investors gain confidence knowing that every stage—from bidding to repayment—is visible on a secure ledger. Costs also drop, since fewer intermediaries are required. Another advantage is programmability: smart contracts can include dynamic terms, adjusting interest rates based on repayment speed or market conditions. Together, these features make blockchain loans appealing to both lenders seeking security and borrowers demanding flexibility. Yet adoption will likely be uneven, with early use cases concentrated in high-value auctions before spreading to broader markets.

Benefits of Blockchain Loans

| Feature | Impact for Borrowers | Impact for Lenders |

|---|---|---|

| Smart contracts | Automatic execution, faster access to funds | Reduced defaults through automation |

| Immutable ledger | Clear record of obligations | Lower risk of disputes or fraud |

| Programmable terms | Flexible repayment options | Dynamic risk management |

| Reduced intermediaries | Lower transaction costs | Fewer administrative layers |

Challenges in Applying Blockchain to Gemstone Loans

Despite its promise, blockchain lending faces real-world hurdles. Legal systems are not yet fully aligned with smart contracts, meaning disputes may still require traditional enforcement. Technical risks also exist: coding errors or vulnerabilities in contracts can be exploited, leading to losses. Additionally, blockchain transactions are irreversible, leaving little room for correction if mistakes occur. Market adoption is another issue. Many auction houses and lenders still rely on paper-heavy systems and may resist digital transformation. Finally, compliance with anti-money laundering (AML) and know-your-customer (KYC) rules complicates integration. For blockchain loans to succeed, regulators and industry players will need to collaborate, ensuring that transparency and automation do not compromise security or accountability.

Challenges of Blockchain Loans

| Challenge | Why It Matters | Possible Solution |

|---|---|---|

| Legal recognition | Smart contracts may lack legal clarity | Develop hybrid contracts with legal backup |

| Technical vulnerabilities | Coding flaws risk financial loss | Independent audits and security protocols |

| Market adoption | Industry slow to digitize | Phased integration with existing systems |

| Compliance | AML/KYC still required | Embed identity verification into contracts |

How Auctions Could Change with Blockchain Loans

Imagine an international gemstone auction where every loan, bid, and repayment is recorded on a transparent ledger. Buyers secure financing through smart contracts that activate instantly when lots are won. Sellers receive immediate payment, while lenders monitor contracts in real time, reducing uncertainty. Over time, such systems could reduce reliance on costly intermediaries and enhance trust in markets often criticized for opacity. Auction houses could integrate blockchain platforms into their bidding systems, creating hybrid models where traditional and digital finance work together. While still in early stages, this future is no longer hypothetical—pilot projects in art and collectibles are already demonstrating blockchain-enabled lending, and gemstones may follow.

What It Means for Auction Participants

Buyers gain speed, sellers gain certainty, and lenders gain transparency. This alignment of incentives makes blockchain lending attractive, even in industries historically resistant to change.

Forward-Looking Outlook

The adoption of blockchain loans in gemstone markets will depend on trust, infrastructure, and regulation. Over the next decade, we are likely to see hybrid models emerge, where traditional contracts coexist with smart contracts, offering both legal enforceability and automated efficiency. Advances in blockchain verification could link directly to gemstone certification, tying loan agreements to proof of origin and ethical sourcing. This could enhance consumer confidence in both the financial and physical aspects of transactions. At the same time, the rise of digital marketplaces may normalize blockchain lending, making it as common as traditional bank loans in high-value auctions. If done carefully, blockchain loans could reshape gemstone trading into a more transparent, efficient, and trustworthy industry.

The Road Ahead

From faster bidding to automated repayments, blockchain may redefine how gemstone investors interact with credit. The key will be balancing innovation with safeguards, ensuring that speed and transparency do not come at the cost of stability.

Conclusion

Blockchain loans bring automation, transparency, and efficiency to an industry long defined by opacity. Through smart contracts, gemstone investors gain faster access to credit, while lenders enjoy greater security. Still, hurdles remain—legal clarity, adoption resistance, and technical risks. As pilot programs expand and regulatory frameworks mature, gemstone auctions could evolve into arenas where credit is no longer a hidden process but an open, automated part of bidding. For investors and dealers alike, blockchain loans may not eliminate risk, but they offer a clearer, faster, and more accountable way to finance transactions in one of the world’s most exclusive markets.